Raise your hand if you think banks are as sound as the Fed says they are.

Stress test results

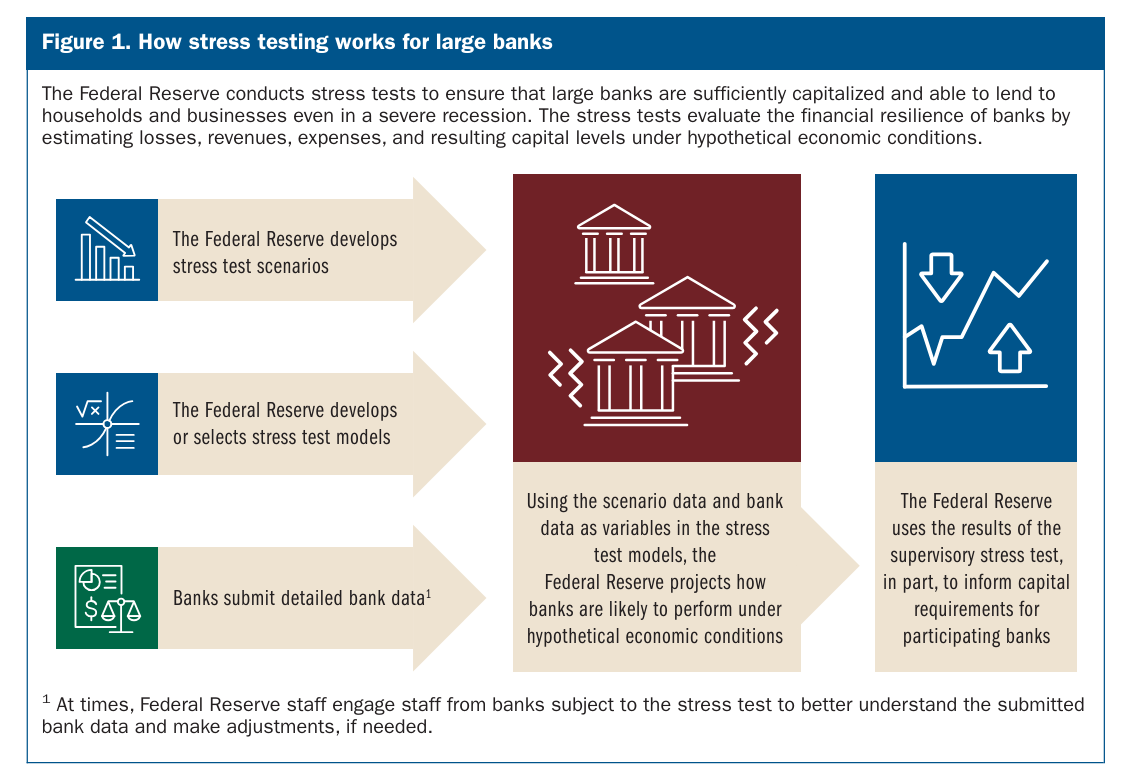

Please consider the results of the Federal Reserve’s 2024 stress test

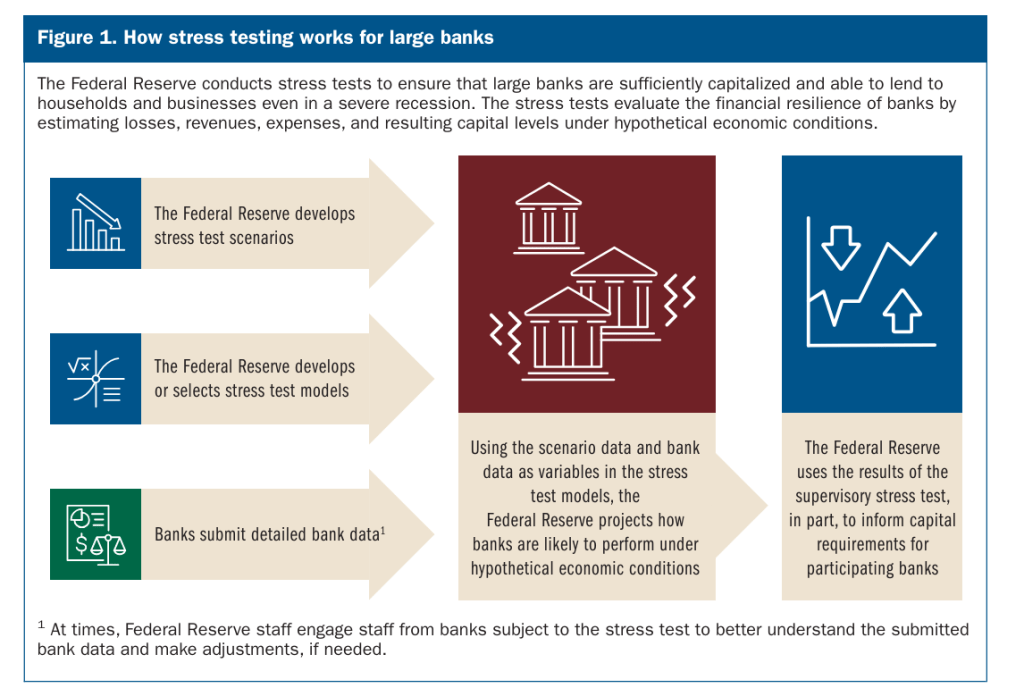

This year’s hypothetical scenario is broadly comparable to last year’s scenario. It includes a severe global recession with a 40 percent drop in commercial real estate prices, a significant increase in office vacancies and a 36 percent drop in housing prices. The unemployment rate rises nearly 6-1/2 percentage points to a peak of 10 percent, and economic output falls commensurately.

The 2024 stress test shows that the 31 big banks undergoing the test this year have enough capital to absorb about $685 billion in losses and continue lending to individuals and businesses under stressed conditions.

The two funding stresses include a rapid repricing of deposits, combined with a more severe and less severe recession. By each element, large banks would remain above the minimum capital requirements in total, with capital ratios falling by 2.7 percentage points and 1.1 percentage points, respectively.

Under the two highlights of the trading book, which included the failure of five major hedge funds under different market conditions, the largest and most complex banks are projected to lose between $70 billion and $85 billion. The results showed that these banks have material exposure to hedge funds, but that they can withstand different types of trading book shocks.

Stress test variables

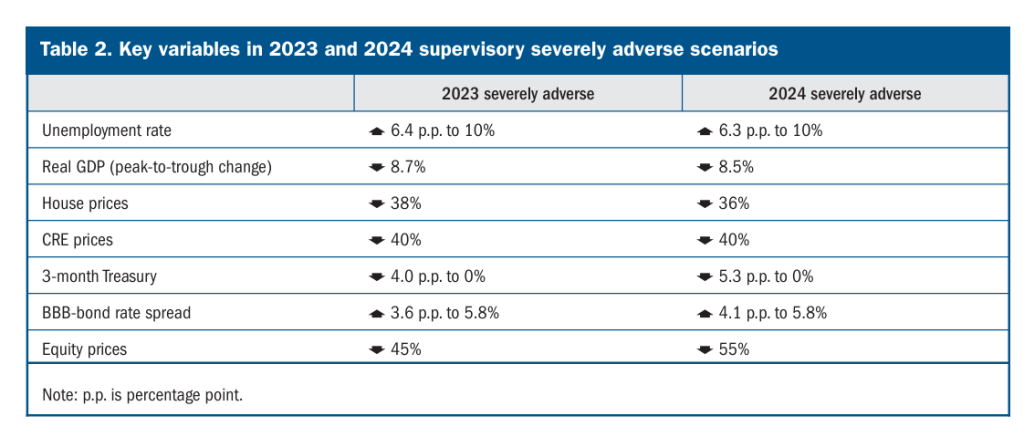

Participating banks

There’s a lot more to the report, so it’s worth a closer look.

Is the stress test that hard?

Going back to the stress test, some items seem extreme, others completely free.

Note the parameters of the 3-month interest rate from 5.3 percent to zero percent. What happens in stagflation if the 3-month rate goes to 11 percent?

Another easy parameter is a stock market decline of 55 percent. What if it’s 75 percent? And 75 percent is not that unusual.

Is a BBB bond spread of 5.8 percentage points that difficult? What if junk bonds are blown out of the water?

Even if the 31 largest banks could miraculously survive, are there 150 or more regional banks that wouldn’t?

Banks want looser regulation

The immediate reaction was exactly what one would expect.

Please note Financial-Industry Group Says Stress Tests Prove Banks’ ‘Capital Strength’, Basel III Proposals ‘Unwarranted’

The Financial Services Forum said Wednesday that the Fed’s stress tests prove that a controversial Basel III endgame proposal to raise capital requirements for banks is not necessary.

“The additional capital requirements in the Basel III Endgame proposal are not justified,” the Bank Policy Institute said. “The nation’s largest banks are well capitalized and are a strong source of support for families and businesses, including in times of stress.”

This is the kind of prayer that nothing can go wrong that you hear at every turning point in the market.

OK guys, why don’t you list all your assets on the market now.

A number of banks, including Silicon Valley Bank, recently faced a rising rate environment.

Q: So what did the Fed’s stress test do?

Answer: A downward rate environment that would save any losses on banks’ treasury holdings by giving banks capital gains.

So raise your hand if you think banks are as sound as the Fed says they are.

#Big #banks #pass #extreme #stress #test #including #percent #unemployment

Image Source : mishtalk.com

Leave a Reply